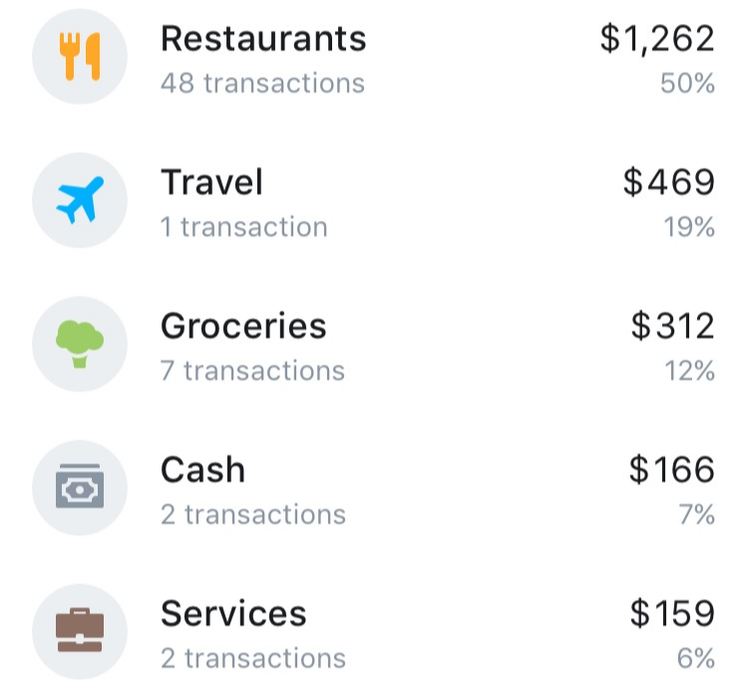

SummaryFirstly, I have not been paid to write this article, but this is a product that I came across that I felt I had to share as it has made my stay in the United States so much easier. Revolut is a financial disruptor, one of a number of recent financial innovations succeeding in London. My job involves me staying up to date with global financial innovations, but it was a colleague of mine who introduced me to Revolut. The company was founded in London in 2014 by a couple of Russian immigrants to the UK and its growth has been pretty incredible. The premise of Revolut is simple - its a global money app that allows people to transfer between a select group of currencies without charging any commission, a fantastic tool for anyone that exchanges currencies on a regular basis. No commissionI opened a bank account during my first week in New York. In all honesty, I was surprised by how quickly they managed to set it up. I entered Bank of America and within an hour they had given me an account and a temporary card while they posted me my permanent debit card. Everyone told me that opening a bank account is a necessary thing you do when you move to another country, but the truth was I was still going to be paid in GBP and I'd have to transfer this to USD and that would attract a fee. Within a couple of months of opening the account, I had closed it. I didn't use it once. The whole thing about financial disruptors are that they take small aspects of large banks services, and they do it well. Banks are large, unwieldy and stuck with legacy systems. These new disrupters are agile and can make use of the latest technologies, that means different innovators can provide different services better. Revolut is one such example. Revolut works as a pre paid card using the MasterCard payment system. This means that theoretically, anywhere that accepts MasterCard also accepts the Revolut card. Twinned with the card is an app for your smart phone, free to download and very easy to set up (create a profile and add your banking details to upload money). The thing that makes Revolut special is the fact that it charges no commission and no fees. Unlike the foreign exchange counters in shops on the High Street (and worse those in airports), you get the interbank lending rate, the same rate that banks use to lend to each other. Basically, the exchange rate you see is the exchange rate you get. It makes foreign exchange providers for holiday makers as well as temporary bank accounts almost redundant. Stay up to date with spendingThe thing about Revolut is that its so much more than just a money app that allows you to transfer money commission free. It also includes functions to transfer money to other bank accounts - anywhere in the world, again free of charge as well as functions for splitting bills. The global money app also has an analytics tool that tracks how much you spend and where you spend it, a very good way of keeping your spending in control. I tend to upload a limit on how much I want to spend and wait for a favourable exchange rate within 7 days of my monthly top up and then exchange my money from GBP to USD. It's great to see how much I spend each month and where I spend it (by country, merchant and activity). The only issue is that the activities function isn't always completely accurate, especially distinguishing between entertainment and restaurants. The support function is also very good. A chat tab allows you to talk to support in real time on weekdays. I've had a couple of issues and these were quickly resolved by the helpful and knowledgeable team on the other side. You can also print off statements in PDF and Excel format in case you need to recall past transactions. Security also seems to be good, a merchant swiped my card 3 or 4 times very quickly and the card automatically disabled as it thought my card had been stolen. To enable the card I quickly logged back into my app and pressed a couple of buttons, very quick, very easy. Now there are catches. Right now there are only three currencies that you can switch between commission free: GBP, USD and EUR. Other currencies (up to 90) attract a small fee, and this rises over the weekend to ensure large movements in the currency markets do not bankrupt the company. Secondly, if you are using the free version there is a limit on the amount of money you can exchange (£5000 a month) and also a limit of money you can withdraw for free (£200 a month). I thought the second point might be an issue, but in a society that is increasingly cashless, its pretty easy to stay within limits and even if you need to access more than £200 a month, the fee attached is still very small (2%). On very rare occasions, the card just doesn't work. Sometimes its in small shops, other times larger stores. Perhaps most frustratingly the card will work 9/10 in a store, but for some reason one day you pay for your stuff and the card just doesn't work. It's happened to me twice in Whole Foods where I do my weekly grocery shop. If there was a reason why this happened, it wouldn't be so bad, but the uncertainty means I always carry a little bit of cash with me, just in case. It's not happened enough for me to think negatively of the service, but its happened enough times for me to always be a little uneasy when I pay for things. The question is, how does the app make money? Well firstly, you have to pay for the card, £12 in the UK, £27 if you order abroad. Secondly, you can buy a premium version where the amount you can exchange or withdraw increases, you get insurance and you also get a fancy card. Finally, as the app grows it will begin to make money from advertising and related services (as long as it doesn't involve selling your data, I don't mind). There are a couple of issues that need ironing out, but on the whole, the card has absolutely changed the way I spend my money abroad. The hope is that Revolut will widen the base currencies from the three it currently has. However, the fact that I have been in the States for almost 6 months without needing a bank account just because of this app proves just how revolutionary it is.

Arven Nelson

30/5/2017 01:47:06 pm

The £5k limit seems to an annual limit. They want extra info, which advice says one should not put on the web, to increase the limit. Thanks for flagging potential of the occasional payment-fail. That will save me panicking!

The Travelling Singh

31/5/2017 01:10:28 am

Thanks for sharing, Arven. I've had the payment-fail on a couple of occasions but on the whole it works smoothly.

Adam

30/5/2017 04:55:44 pm

An amazing card, absolutely love it.

The Travelling Singh

31/5/2017 01:14:37 am

Absolutely agree. It's a shame that every so often payments do not go through, but on the whole these are rare. The service as a whole is fantastic. Comments are closed.

|

AuthorBritish Sikh, born in the Midlands, based in London, travelling the world seeing new cultures. Categories

All

|

RSS Feed

RSS Feed